Offshore Trust Setup Fees and What You Should Plan For

Offshore Trust Setup Fees and What You Should Plan For

Blog Article

Understand the Unique Advantages of Making Use Of an Offshore Trust for Global Property Protection

When it pertains to guarding your assets, comprehending overseas trusts is important. These monetary tools can supply a layer of defense against legal claims and political instability. You may be shocked by just how they can boost your personal privacy and deal adaptable asset administration alternatives. Yet what precisely makes offshore counts on an engaging selection for those wanting to secure their wide range? Allow's check out the distinct advantages that could alter your financial strategy.

What Is an Offshore Trust?

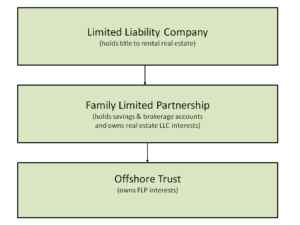

An offshore Trust is a legal setup where you transfer your properties to a trust fund based in an international nation. This setup allows you to manage and shield your riches while possibly enjoying tax obligation advantages and privacy. By positioning your possessions in an overseas Trust, you divide your individual possession from the assets, which can supply you with greater control and adaptability in handling your investments.

You can mark a trustee, who will oversee the Trust and assure it operates according to your instructions. This plan can be particularly beneficial if you have worldwide connections or strategy to travel regularly, as it can streamline the administration of your assets across borders.

In addition, offshore trusts usually include stringent confidentiality laws, allowing you to maintain your economic affairs exclusive. On the whole, making use of an offshore Trust can be a strategic step for those seeking to enhance their property administration and protection on an international scale.

Asset Defense From Legal Claims

Offshore counts on supply substantial asset defense from legal claims, securing your riches against possible legal actions and financial institutions. By placing your possessions in an offshore Trust, you produce a barrier that makes it harder for claimants to access your wealth. This added layer of defense can deter pointless legal actions and provide you comfort understanding your hard-earned properties are safe and secure.

In lots of jurisdictions, offshore counts on take pleasure in strong lawful structures that focus on the privacy and safety of your properties. This indicates that also if you deal with lawful obstacles, your Trust's possessions are usually protected from seizure - offshore trust. In addition, the separation of legal possession from valuable possession can make complex attempts by lenders to reach your assets

Eventually, using an overseas Trust not just protects your possessions however likewise enables you to concentrate on what really matters, without the consistent worry of potential legal cases threatening your monetary security.

Shielding Riches From Political Instability

When political instability intimidates financial safety, making use of an overseas Trust can be a wise action to safeguard your riches. By putting your possessions in a territory with steady political and financial problems, you can safeguard your financial investments from possible government seizures or undesirable laws in your home nation. Offshore depends on supply a layer of security that helps guarantee your wide range stays intact during stormy times.

Additionally, these depends on can be structured to provide versatility in exactly how and when you access your assets, allowing you to adapt to altering scenarios. You can determine terms that prioritize your financial health, assuring your sources aren't at threat from neighborhood political chaos.

Moreover, offshore depends on can assist you expand your investments internationally, spreading out risk throughout different markets. This strategy not just shields your wealth however additionally improves prospective growth, enabling you to weather political storms with greater confidence.

Privacy and Discretion Perks

Boosted Possession Privacy

Utilizing an offshore Trust can greatly improve your possession privacy. By positioning your wealth in a trust fund developed in a jurisdiction with strong personal privacy legislations, you develop a barrier against prying eyes.

Moreover, overseas trusts normally do not require public registration, implying your economic details stay confidential. You'll take advantage of the competence of professionals who recognize regional policies and can browse the complexities of asset defense. In this method, you can maintain your personal privacy while securing your riches from potential risks, ensuring that your monetary legacy stays very discreet and safe and secure.

Reduced Public Disclosure

Offshore trusts use considerable benefits in minimizing public disclosure, giving you with improved privacy and discretion. When you develop an overseas Trust, you can maintain your economic affairs out of the general public eye, safeguarding your assets from spying eyes. Unlike onshore trust funds, which frequently need detailed disclosures, offshore counts on usually include minimal coverage demands. This implies your personal details and the details of your assets continue to be private.

In addition, the jurisdictions where offshore trust funds are developed usually have rigorous personal privacy regulations, even more safeguarding your monetary info. By utilizing an overseas Trust, you're not simply securing your wide range; you're additionally making certain that your monetary decisions stay personal, permitting you to manage your possessions without unneeded examination or disturbance.

Legal Security Methods

Developing a legal framework around your overseas Trust can significantly boost your privacy and confidentiality. By establishing an overseas Trust, you develop a barrier in between your assets and prospective plaintiffs. This splitting up ensures that your financial details stays secured from public analysis, offering you peace of mind.

Additionally, several territories use rigid privacy laws that safeguard your monetary and personal information. This implies fewer chances of undesirable exposure or legal difficulties. You likewise gain the capacity to appoint a trustee that can manage your possessions quietly, further guaranteeing your information stays confidential. Generally, leveraging these legal defense strategies not just fortifies your property safety yet additionally enables you to keep control over your monetary legacy without unneeded disturbance.

Flexibility in Possession Monitoring

While navigating through the complexities of international asset click now administration, you'll find that adaptability is vital to optimizing your overseas Trust. This adaptability enables you to respond swiftly to changing circumstances, whether they're economic changes, legal growths, or personal objectives. You can change your financial investment techniques, allocate assets in varied jurisdictions, or also change trustees to better align with your objectives.

Furthermore, overseas trust funds usually supply different investment alternatives, allowing you to expand your profile while mitigating risks. You can tailor your Trust to fit your certain requirements, from adding or eliminating recipients to changing distribution terms. This level of customization not only enhances your control over your possessions however also guarantees that your economic methods progress as your life situations change.

Eventually, the versatility fundamental in overseas counts on empowers you to make enlightened choices that secure your wide range in an unforeseeable globe.

Possible Tax Benefits

When taking into consideration worldwide possession monitoring approaches, prospective tax obligation advantages typically come to the forefront. Using an overseas Trust can supply you site link with numerous benefits that may assist minimize your tax liabilities. By putting your assets in a trust situated in a desirable territory, you might make use of lower tax prices or perhaps tax obligation exemptions.

Many overseas jurisdictions supply appealing tax motivations, which can bring about considerable savings. Some may not impose capital gains or inheritance tax obligations, permitting your wealth to expand without the burden of significant tax responsibilities. You'll also appreciate the versatility to structure your rely on a method that straightens with your economic goals.

Bear in mind, nevertheless, that conformity with worldwide tax obligation regulations is crucial. You'll require to stay informed to guarantee your overseas Trust continues to be compliant and useful. In general, an offshore Trust might be a wise relocation for optimizing your tax situation.

Picking the Right Territory for Your Trust

Selecting the right territory for your Trust can considerably affect its performance and your total monetary technique. First, consider the legal structure of the jurisdiction. Some locations use solid possession protection laws, which can protect your possessions from lenders. You'll wish to look at the tax implications too. Particular territories give favorable tax obligation treatments that can boost your returns.

Next, think of the economic and political security of the area. A steady setting minimizes dangers related to currency variations or adjustments in regulation. Additionally, analyze the administrative needs. Some territories may have complicated rules that can complicate your Trust monitoring.

Lastly, think about the online reputation of the jurisdiction. A well-regarded location can offer trustworthiness to your Trust, making it easier moved here for you to collaborate with banks. By very carefully evaluating these variables, you can select a territory that lines up with your property security goals.

Often Asked Concerns

Just how much Does It Cost to Establish an Offshore Trust?

Setting up an offshore Trust typically sets you back between $2,000 and $10,000, depending on complexity and jurisdiction. You'll wish to consider recurring fees for upkeep and compliance, which can add to your general expenditures.

Can I Manage My Offshore Trust Remotely?

Yes, you can manage your offshore Trust remotely. Lots of trustees supply online gain access to, allowing you to oversee financial investments, make choices, and communicate with your trustee from anywhere, guaranteeing you stay in control of your assets.

What Sorts Of Assets Can Be Put in an Offshore Trust?

You can position different properties in an overseas Trust, including money, property, financial investments, and organization interests. Each asset kind provides distinct advantages, assisting you branch out and secure your wide range efficiently.

Are Offshore Trusts Legal in My Country?

You need to check your nation's laws pertaining to offshore depends on, as validity differs. Lots of nations recognize them, but specific laws might use. Consulting a legal expert can provide quality customized to your situation and jurisdiction.

Just how Do I Select a Trustee for My Offshore Trust?

Picking a trustee for your overseas Trust involves investigating credible companies or individuals, reviewing their experience, understanding costs, and ensuring they straighten with your objectives. Trustworthiness and interaction are vital for effective monitoring of your possessions.

Verdict

In verdict, making use of an offshore Trust can be a game changer for your global property defense strategy. Consider an offshore Trust to safeguard your assets and guarantee tranquility of mind.

An overseas Trust is a legal arrangement where you transfer your properties to a depend on based in an international nation. By placing your assets in an offshore Trust, you separate your individual possession from the possessions, which can provide you with higher control and adaptability in managing your investments.

In many territories, offshore depends on enjoy solid lawful structures that focus on the personal privacy and security of your possessions. When you develop an offshore Trust, you can keep your economic events out of the public eye, protecting your possessions from spying eyes. Unlike onshore trust funds, which commonly require thorough disclosures, offshore counts on generally involve minimal coverage needs.

Report this page